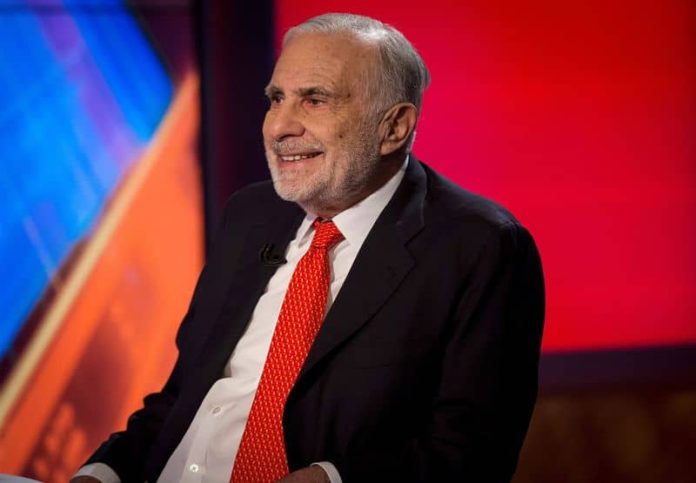

(Reuters) – Hindenburg Research said on Tuesday it has a short position in activist investor Carl Icahn-controlled energy-to-pharma conglomerate Icahn Enterprises, making it the latest in a string of recent high-profile targets of the U.S. short seller.

Shares of Icahn Enterprises fell nearly 10% in premarket trading after Hindenburg alleged that the valuation of IEP units was inflated by more than 75% and that “IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables.”

Icahn Enterprises did not immediately respond to a request for comment and Reuters could not independently verify the claims the short-seller has made in its report.

Hindenburg also claimed Icahn was operating a “ponzi-like economic structure,” selling its units to new investors to support its dividend payouts.

“In brief, Icahn has been using money taken in from new investors to pay out dividends to old investors.”

Based in Sunny Isles Beach, Florida, Icahn Enterprises is one of the most successful activist investment firms and the chief investment vehicle of Icahn, who is known for his face-offs with several high-profile firms.

As of last close, shares were down marginally this year, giving Icahn Enterprises a valuation of roughly $18 billion.

Earlier this year, Hindenburg’s report on India’s Adani Group triggered a more than $100 billion rout in the conglomerate’s shares, and last month, the short seller took aim at Jack Dorsey-led Block Inc.

Hindenburg invests its own capital and takes short positions against companies. After finding potential wrongdoings, it usually publishes a report and bets against the target company, hoping to make a profit.

Short sellers typically sell borrowed securities and aim to buy these back at a lower price.