consumer price index

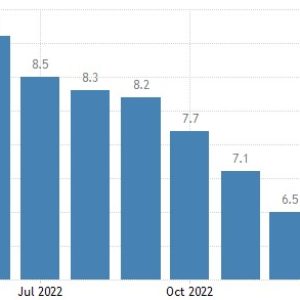

The annual rate of inflation in the United States probably slowed for the ninth time in a row to 5.2% in March 2023, the lowest level since May 2021 from 6% in February due to lower energy and food costs. On a monthly basis, the CPI is expected to have increased by 0.2%, half of the previous increase of 0.4%. On the other hand, core inflation is expected to rise for the first time in six months to 5.6% from 5.5%, with the monthly rate coming in at 0.4% compared to 0.5% in February, supported by higher housing prices. At the same time, inflation in basic services, such as transportation and medical care, is expected to deflate

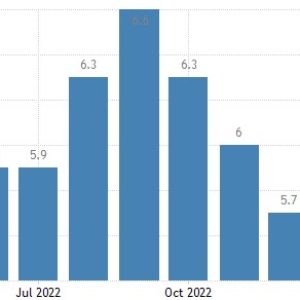

Core Consumer Price Index Core consumer prices in the United States, which excludes volatile items such as food and energy, rose 0.5% month-on-month in February 2023, following a 0.4% increase in January and above market expectations of 0.4%. Categories that increased in February include shelter, recreation, home furnishings and operations, and airfare. The used cars and trucks index and the Medicare index were among the indices that declined during the month. On a yearly basis, core consumer prices rose 5.5 percent, in line with expectations

Technically, the US dollar index is trading in a downward trend, with bottoms below each other. If the 102.745 level is breached and a peak is recorded above, it will be a reflexive and positive sign for the US dollar. As for maintaining the last level, it supports the negative scenario and recording negative inflation data today, which will push the dollar index to the levels of 101.090 and 100. .700

The markets are witnessing a difference in the opinions of some members of the Federal Reserve regarding monetary policy, most notably:

New York Federal Reserve Chairman John Williams:

“The Fed is still facing the challenge of curbing inflation, which means continuing the current monetary policy path” (monetary tightening, interest rate hike)

President of the Federal Reserve in Chicago, Austin Goolsby:

“Assessing the repercussions of the banking crisis, which necessitates postponing the interest rate hike” (reducing the pace of interest rate hikes)

– Minneapolis Fed President Neel Kashkari: “The worst repercussions of the banking crisis are over” (hint for a rate hike if needed)

Attention is directed to the prices of services, which in turn will not retreat from the level of 7.6 since the beginning of the decline in inflation rates, in contrast to the prices of commodities, energy and food.