Gold is inches away from its biggest breakout in 50 years and the start of a new secular bull market. It may have already happened by the time you read this.

Gold is also beginning a new cyclical bull market with strong potential to soar to $4000-$5000 over the next several years.

Any average Gold or Silver is poised to perform well but our goal is to uncover the companies with potential for some of the biggest gains.

This does not entail buying low-quality companies that are highly leveraged to the bull market. Moreover, it entails buying quality companies with strong potential to add value that will be magnified by the bull market.

There are certain types of companies we should look for, as well as certain types to avoid.

I will begin with the types of companies to avoid.

This revolves around a particular stage of a junior miner’s life cycle.

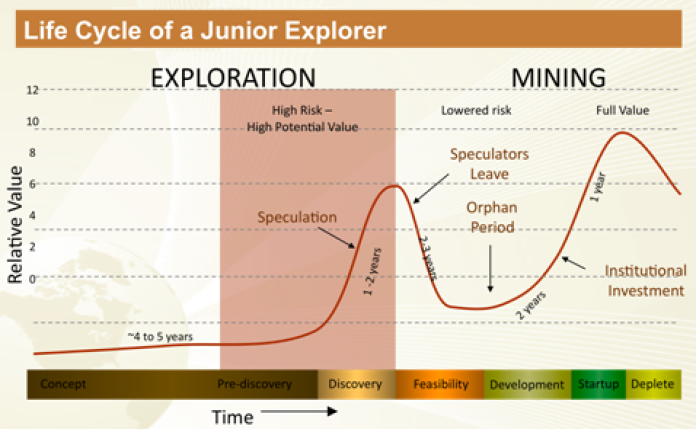

Brent Cook’s image shows a typical life cycle for a junior company that decides to build the mine. Otherwise, the company could be acquired or never make it to the development stage.

The best stage to buy is at the beginning of discovery or the months before initial production.

We want to generally avoid development companies that are too far from production or stuck in the development stage because their projects are of low quality.

With that out of the way, let’s focus on these two types of companies.

First, I favor small companies with production growth potential. These companies have the asset or assets from which they can grow production. The market always loves growth and pays a premium.

Within this group, we want to find companies that can grow without destroying their capital structure and diluting their shareholders. Look for companies doing a phased approach or those able to fund growth with limited dilution.

The second type of company is exploration companies that are early in the discovery stage. I try to find explorers that have a discovery or something with defined value (a backstop) that has the potential to grow much larger and more valuable.

This is a more difficult task than finding growth-oriented producers because there are far more of these companies, and exploration outcomes are much less predictable.

The key here is finding the projects that have significant upside potential. Too many projects have minimal upside potential.

What I deem as “The Holy Grail” is when a junior producer encounters significant exploration success. Some of the biggest winners in recent years (i.e. Kirkland Lake) were producers who made a significant discovery.

Producers have the cash flow to fund exploration, and they already have the infrastructure which can facilitate immediate production growth after a discovery.

In short, look for the junior producers who are trying to make a significant discovery.

Companies with production growth potential and material exploration and discovery potential are poised to be the leaders over the coming years.