5/24/2023 at 10:05 GMT

After Yesterdays S&P Global PMIs came out looking like mixed, but in fact it aligns on one direction which is a bullish USD. Yesterday the headline S&P Global came out higher than consensus and the previous reading which implies the market can take a rate hike ad this is USD bullish. However, the manufacturing component came out lower than consensus which triggered fears of a recession and this is USD bullish as well. As a result, we finished the day on a sour note with DXY closing higher, SP500 lower and the US10 Year Yields closing in red.

Today we have the FOMC minutes release later during the New York session as the major daily event in the economical docket. As of the time of writing, the sentiment is mixed where DXY is trading in red with -0.12%, the S&P500 Futures -0.08%, and the US10YY +0.19%.

On the technical level, DXY closed yesterday with a bullish engulfing candle forming a swing low and signaling a bullish continuation towards the next resistance 103.850 zone Fibonacci retracement 61.8% on the daily time frame followed by 104.25 zone Fibonacci retracement 70.5% on the daily time frame. This setup opens up several opportunities to buy USD against risk assets. A firm breakout from 103.65 shall confirm the bullish continuation.

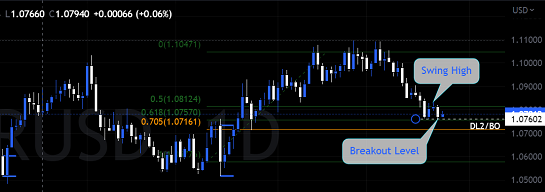

My top selection for daily analysis today is EURUSD where the technical setup is perfectly aligned with the fundamental view and daily market sentiment. On a technical level EURUSD has formed a swing high and yesterdays daily engulfing candle adds another confirmation making its low the confirming breakout level for a bearish continuation.

EURUSD is my best pick as a trading idea for today. However, I’m biased that risk assets like EURUSD, GBPUSD, NZDUSD could suffer a red day giving us shorting opportunities. I prefer to keep commodity currencies (AUDUSD + USDCAD) and Oil (WTI) on the watch till high probability trading opportunities show up. However, the precious metals are indeed correcting and might open short opportunities for today where I prefer shorting Silver on Gold if I need to add a second favorite besides EURUSD.