The US dollar index crossed the 102-point barrier immediately after the release of important US economic data, as a new upward impetus reached the US dollar index after US banks reported tight credit restrictions and revealed a weak demand for borrowing in the second quarter, and this information showed that raising US interest rates affected The US economy hurt the risk sentiment

Fed Chair Jerome Powell was serious and focused on noting the importance of upcoming economic data in the decision making process and therefore the focus will be well and truly on Friday with the June jobs report which is expected to confirm a solid labor market.

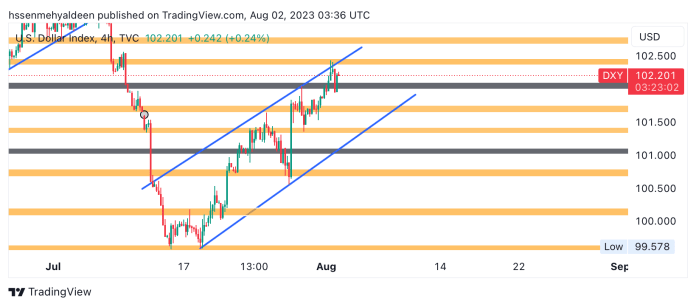

The dollar is in an upward sub-trend, and currently the price is at the 102.200 area. If stability is established below the 102.051 area, we will see the areas of 101.340/101.011, and if we break the 101.011 area, we will see the 100.670 area, but if we break the 102.409 area, we will see a rise towards the areas of 102.740/103.053