Inflation in the US continued to slow, giving the Federal Reserve room to take a breather from rising interest rates. Today, the Consumer Price Index was released at 4% in May from a year earlier, and basic services inflation has subsided, except for housing.

Where it is expected that it will come with an interest rate fixation at 5.25%, however, bets are rising about the remainder of 2023, which will certainly be decided by the trends of inflation data, and the annual inflation data fell to its lowest level since September 2021. Of course, waiting for the interest decision tomorrow, will there be a fixation of the interest rate or not?

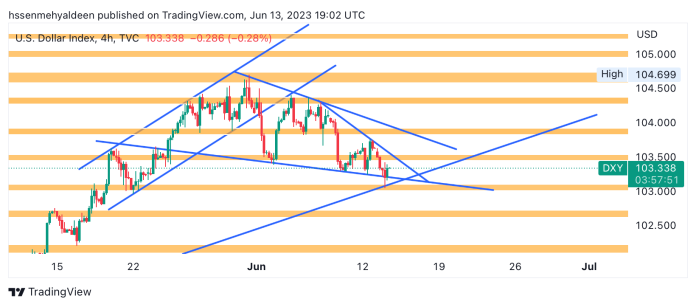

Currently, the dollar index fell after today’s data, reaching the 103.050 area, and rebounding from it to reach 103.350. In the event of stability above the 103.700 area, we will see the areas of 104.300/104.600, but in the event of stability below the 103.000 area, we will see the areas of 102.600/102.000