Private sector employment report

يحدد مستوى التغير في مستوى الناس الموظفين خلال الشهر الماضي باستثناء قطاع الزراعة

Determines the level of change in the level of people employed over the past month excluding the agriculture sector

Job creation is an important indicator of economic recovery, which is largely related to human resource conditions and a large part of GDP

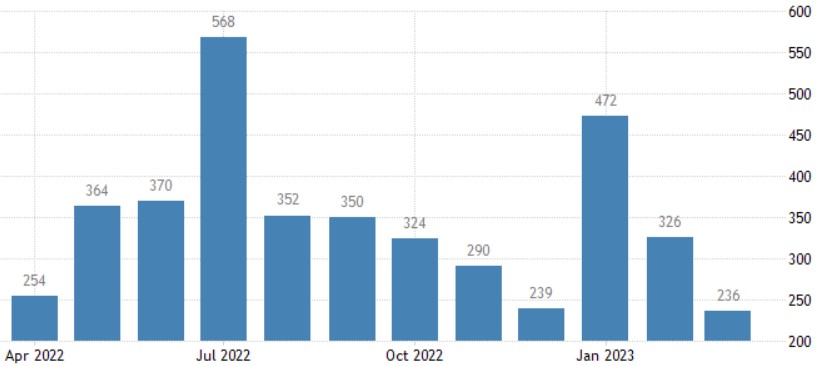

The US economy is expected to add 180,000 jobs in April 2023, the smallest gain since December 2020, after a rise of 236,000 in March. This marks the third consecutive month of slowdown in hiring as the labor market returns to normal after the shocks of the pandemic. In addition, higher borrowing costs and rates forced some companies to cut costs, and distortions related to the Easter holiday affected employment. However, the April reading would still be well above the 70k-100k monthly job gains needed to keep up with growth in the working-age population. The services sector, especially entertainment and hospitality, is expected to create the most jobs, while a decline in manufacturing jobs is expected. Meanwhile, the unemployment rate is expected to rise to 3.6% from 3.5%, which would still be near a five-decade low. Wages are expected to rise 0.3%, as they were in March, and annual wage growth is also expected to hold steady at 4.2%.

Outlook for today’s statement and how it will affect the currency

The estimate for today’s data is 181,000 jobs

If the data is released above expectations, the effect will be positive on the currency and vice versa

Unemployment rate

The unemployment rate determines the proportion of the total labor force that is not employed and actively seeking a job during the past quarter

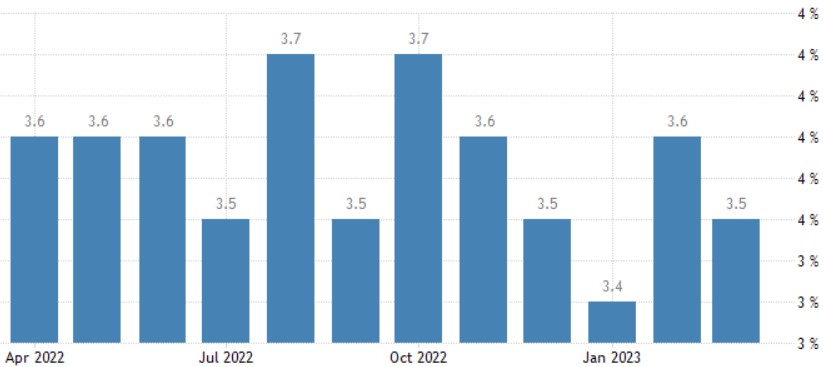

The unemployment rate in the United States fell to 3.5 percent in March 2023, against expectations that it would stabilize at 3.6 percent. The number of unemployed decreased by 97 thousand to 5.839 million and employment levels increased by 577 thousand to 160.892 million. The so-called U-6 unemployment rate, which also includes people who want to work but have given up on searching and who work part-time because they can’t find full-time work, fell to 6.7% in March from 6.8%. Meanwhile, the labor force participation rate rose to 62.6% in March from 62.5% in February, the highest since March 2020.

Outlook for today’s statement and how it will affect the currency

Markets expect the unemployment rate today to be 3.6%.

In the event that the unemployment rate records a reading higher than expected, we will have a negative impact on the currency, as it indicates a rise in unemployment, and vice versa

Here is a reminder about the employment, unemployment and economic data for the United States that were released during this week, and accordingly the expected scenario for today’s report

سجل مؤشر أسعار نفقات الإستهلاك الشخصي الأساسي قراءة مطابقة للتوقعات بمعدل 0.3

The core PCE price index came in as expected at a rate of 0.3%.

The Manufacturing PMI for the specified states recorded a positive reading at 47.1, higher than the forecast of 46.8 (positive result).

US Employment Opportunities came in negative at 9.59M, below the forecast of 9.74M (Negative result).

The Non-Farm Payrolls Decision issued by (ADP) recorded a positive reading of 296K, higher than the forecasts of 148K (Positive result).

The services PMI for the United States recorded a positive reading of 51.9, higher than the forecasts of 51.8 (positive reading).

Unemployment Claims came in at a negative reading of 242k, higher than expectations of 239k (negative result).

The expected scenario for employment data today

Recently, the labor market is witnessing a noticeable improvement as a result of the market pricing to ease the pace of monetary tightening by the Federal Reserve, and if we look at the decision to change non-farm private sector jobs (ADP) issued on Wednesday, May 3, we are witnessing a good rise in employment in contrast to what It was shown by the employment opportunities statement and the unemployment claims rate, which in turn recorded a negative reading

The markets expect a decline in employment data today to 181 thousand, which is lower than the previous month, which recorded 236 thousand, which indicates negativity and a decline in the labor market. On the other hand, the Federal Reserve has expressed its commitment to fighting inflation to target a rate of 2%. It also mentioned that there will be no decrease in interest rates. For this year, these data negatively affected the labor market, in contrast to what was highlighted by the decision to change jobs in the non-agricultural private sector issued by (ADP).