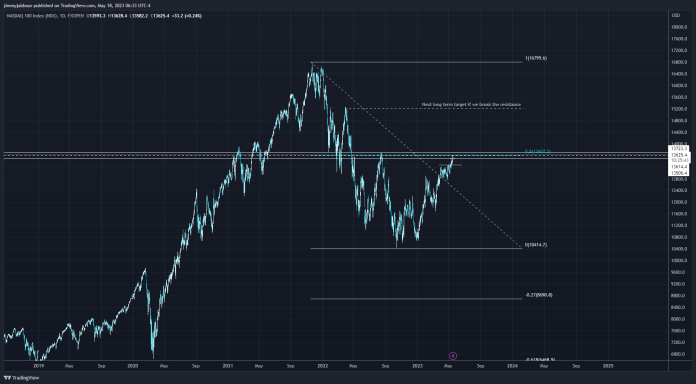

The Nasdaq Composite Index (COMP) is now trading at 13,700, a 1.5% increase from the previous day. In the medium term, the index is in a rising trend channel, with support at 13,200 and resistance at 14,000. The index is approaching resistance at 13,700, which may cause a negative reaction. A break over 13,700, on the other hand, would be a good indicator.

The index is trading above its 50-day moving average, indicating a positive short-term trend. The index is also trading above its 200-day moving average, indicating a positive long-term trend.

Levels to keep an eye on include:

Support: 13,200

14,000 resistance

13,500 is the 50-day moving average.

13,000 is the 200-day moving average.

A two-way situation is possible:

The index may break over resistance at 13,700 and continue to rise.

The index might fall back around 13,200 before resuming its upward trajectory.

The index might go below the 13,200 level and initiate a downturn.

The Nasdaq Composite Index is on a positive trend overall. However, a fall to support at 13,200 is possible. If the index falls below support, it may enter a downtrend.

Here are some of the things that might have an impact on the Nasdaq Composite Index in the near future:

Economic data: The publication of crucial economic statistics, such as GDP growth and unemployment, may influence market mood and the index’s trajectory.

Earnings reports: The publication of earnings reports from large corporations may also have an impact on market mood and the index’s trajectory.

Any Major geopolitical incident

Avoid trading the AM New York session today as crucial data related to unemployment is released at 8:30 eastern time