US dollar index

The US dollar index rose at the end of last week as a result of the preliminary reading of inflation by the University of Michigan, registering a rate of 4.6%, higher than the previous month, by 1%, supported by the statements of some members of the Federal Reserve, which indicated the possibility of more rate hikes in the coming period, which changed the standards somewhat in the markets.

Technically, after the dollar index touched the level of 100.420, it rose by about 0.76% to touch the level of 101.435. If the previous bottom at the level of 100.420 is maintained, the target is at the level of 102.045.

Note: The US dollar is trading in a general bearish trend on the daily timeframe, unlike the four-hour time frame, as it reversed its direction from bearish to upward, and the medium-term target is 102.045 before the possibility of a regression.

gold

With the recovery of the US dollar at the end of last week, gold retreated $56 from its highest peak at the level of 2048.670 since 2020, but this decline is only corrective and a new buying opportunity for gold to touch the target at the level of 2048, the positive scenario for gold is canceled if it records a bottom on the daily frame The lowest level is 1981,013

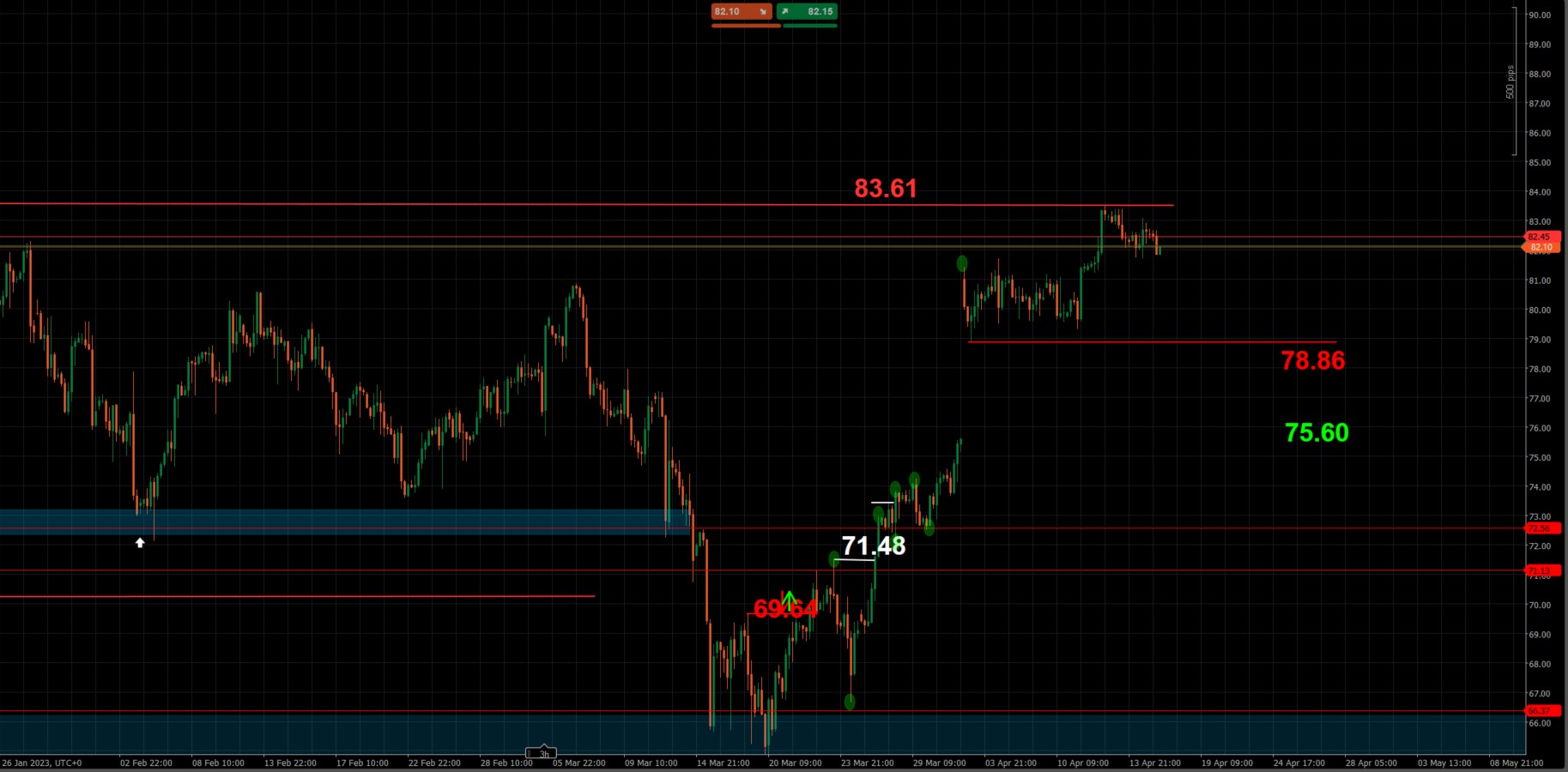

Råolja

Crude oil is trading in a general upward trend, but traders should pay attention to the level of 83.31, which crude oil will not penetrate since December 1, 2022, which raises the possibility of a decline and weakens purchasing opportunities. Also, crude oil still has a positive price gap as a result of the OPEC Plus decision to cut production, which it will not trade. price to date

The best scenario for crude oil is to record a bottom below 78.86 to target 75.60, and the other scenario is to wait for recording a top on the daily frame above 83.61, which will take crude oil out of the long-term horizontal trading, and of course it will be a positive sign for a further rise in crude oil prices.

Euro against the US dollar

The EURUSD fell 0.98% at the end of last week, to breach the last high-low on the four-hour chart, as it indicates a reversal signal from the upside to the downside.

The scenario for the euro-dollar pair is negative, and the rise to 1.10501 represents an opportunity for the price to decline again and target 1.09609. The scenario is canceled if the price breaches 1.09609 and 1.10766.

The US dollar against the Canadian dollar

This pair is trading in a general downward direction, reaching an important support area located at 1.33299 and 1.32742 levels, where it bounced upwards by about 0.70%, the rise that occurred is corrective to complete the bearish trend, and the level of 1.35014 represents an opportunity to decline again for this pair to target 1.33393

The negative scenario is canceled if the top of the highest level 1.35535 is recorded