The dollar index, which measures the currency against a basket of peers, was flat at 104.62, but was still set for a February gain of 2.6%, its first monthly increase since September.

“The dollar has made its rebound – fully justified – on the strength of the January numbers that came through in February, and the repricing for the Fed,” said Ray Attrill, head of FX strategy at National Australia Bank, referring to the strong run of U.S. economic data.

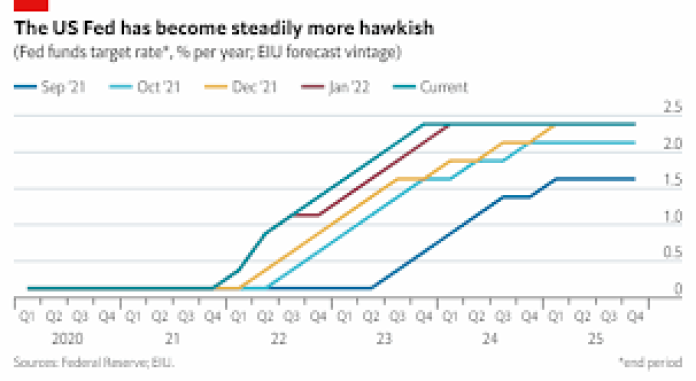

Investors now expecting the Fed funds rate to peak just above 5.4% by September, compared with an anticipated peak of around 4.70 at the start of the month.

“I think we’re sort of lurching from one major data print to another… The next move in the dollar is really a function of how the February data starts to play out in March,” Atrill said.

U.S. Treasury yields have also moved higher with the inflation sensitive two-year yield back at three-and- a-half-month highs.

The dollar on Tuesday gained particularly against the Japanese yen, climbing 0.44% to 136.84, its highest in over two months.

Japan’s policy of keeping yields pinned down means the yen is sensitive to yield moves elsewhere, though incoming Bank of Japan (BOJ) Governor Kazuo Ueda said this week it was premature to comment on how the central bank may shift policy.

And on Tuesday, incoming Deputy Governor Shinichi Uchida brushed aside the chance of an immediate overhaul of the BOJ’s ultra-loose monetary policy.

“The initial signs from Ueda are that he’s in no rush (to change policy), and as long as he’s not in a rush if yields go higher then that continues to pressure the yen,” said John Hardy, head of FX strategy at Saxo.