Our last article compared emas today with the stock market in the early 1980s.

Today we draw some comparisons between the Gold market at present and the Gold market at various points in the past.

Gold’s status today fits elements of three past situations.

Gold is on the cusp of a major breakout today, although it does not appear imminent.

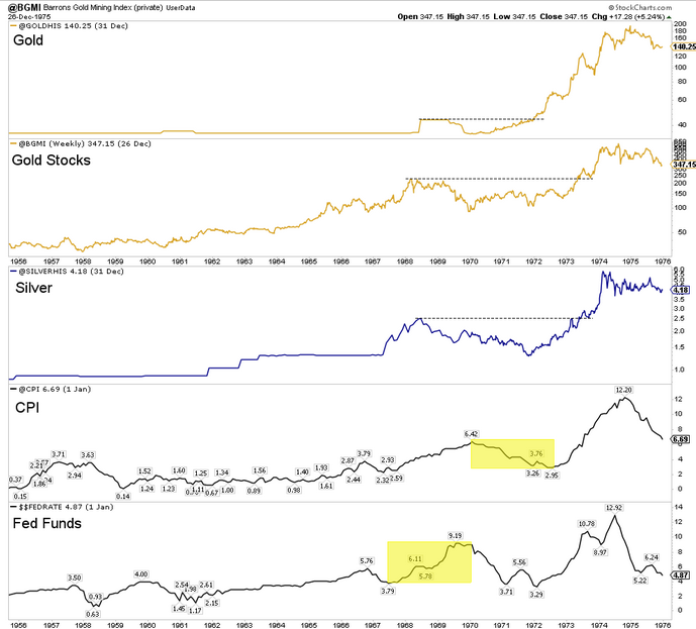

The last time Gold was on the cusp of a major breakout from a multi-decade base to new all-time highs was in 1971-1972. However, that was artificial as the Gold price was fixed at $35/oz throughout the inflationary 1960s.

The gold stocks could be considered a proxy for Gold before 1971. They made a very significant multi-decade breakout in 1964-1965.

The mid-1960s are also a reasonable comparison from a macro standpoint due to the breakout of inflation after being dormant for many years, very low expected returns in stocks and bonds, and the approaching secular bull market in US stocks.

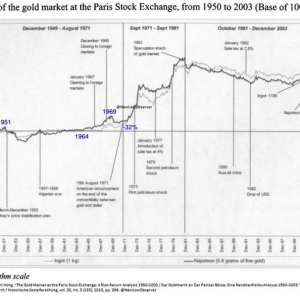

[caption id=”attachment_15737″ align=”alignnone” width=”300″] Furthermore, the image below, courtesy of @NewLowObserver (with my annotations), shows that the Gold price on the Paris Stock Exchange broke out in 1965.[/caption]

Furthermore, the image below, courtesy of @NewLowObserver (with my annotations), shows that the Gold price on the Paris Stock Exchange broke out in 1965.[/caption]

[caption id=”attachment_15740″ align=”alignnone” width=”300″] The Gold price in Paris peaked in 1969 and corrected by 32% over two and three-quarters years. Then, the Gold price in Paris made a new all-time high a little more than three years after the 1969 peak.

The Gold price in Paris peaked in 1969 and corrected by 32% over two and three-quarters years. Then, the Gold price in Paris made a new all-time high a little more than three years after the 1969 peak.

This leads me to the second historical comparison: 1968 to 1972. This period is the best comparison to today from a macroeconomic and precious metals correction standpoint.

After inflation broke out to the upside in 1965, the Federal Reserve hiked rates from 3.75% to 9.0% in 1969. Gold stocks (the proxy for Gold) and Silver peaked in early 1968, over 18 months before inflation peaked.

Depending on where you measure the peak in Gold, it took three and a half years or less than three years to make a new high. (Recall the Gold price in Paris needed a bit more than three years). [/caption]

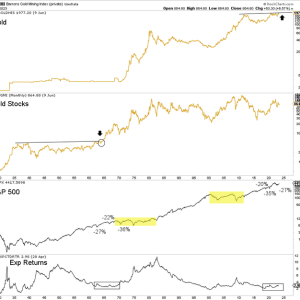

[caption id=”attachment_15742″ align=”alignnone” width=”300″] Finally, our third comparison is entirely technical.

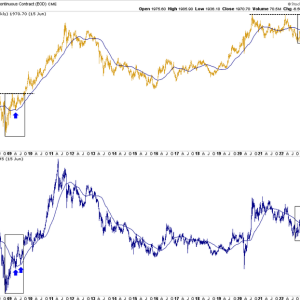

Finally, our third comparison is entirely technical.

The recent price action in Gold (and in Silver) strongly resembles the price action following the October 2008 low. Note the rectangles.

Silver has grinded higher but well below the previous peak, while Gold failed to breakout but should consolidate bullishly. [/caption]

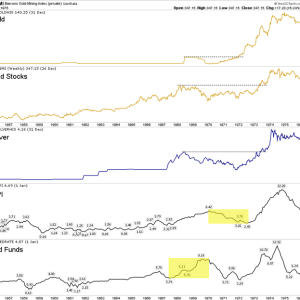

[caption id=”attachment_15744″ align=”alignnone” width=”300″] The most important takeaway is that in a similar macroeconomic situation to today, the precious metals sector required more than a few years to surpass its previous highs. Gold needed three to three and a half years, depending on how you measure it.

The most important takeaway is that in a similar macroeconomic situation to today, the precious metals sector required more than a few years to surpass its previous highs. Gold needed three to three and a half years, depending on how you measure it.

Gold is coming up on year three, and it may feel like it will never break to the upside and begin a real bull market.

But study history and consider how well Gold is holding up.

The stock market has broken out, the Fed is not done hiking, a recession is not imminent, and real interest rates, after a historically significant increase, have yet to decline. But Gold closed at $1971 and is 6% from a new all-time high.

The market knows something.

Speculators and investors have time to research and uncover the best opportunities while they remain cheap. This correction is also the time to reconsider the strong stocks you missed. [/caption]