Benchmark

Influence

Score

Lizenzen

Contact Number

+852 5808 2921

+60 16 299 9449

+44 203 608 6100

Other ways of contact

Broker Information

Company Name

Tickmill

Platform registered country and region

Großbritannien

Cyprus

South Africa

Malaysia

Company website

YouTube

About Tickmill

For this Tickmill review, we opened a live account and deposited over US$ 8,000.

We traded the popular instrument in each market to identify the average spread and placed 12 trades in total.

We contacted the broker’s customer support to resolve the challenges we faced.

Finally, we withdrew all our funds to discover if there are any issues with withdrawals.

Tickmill is a global Forex and CFDs broker, founded in 2014.

The broker is headquartered in London but is licensed by regulators in the UK, Cyprus, South Africa, Seychelles, and Labuan (Malaysia).

Tickmill has offices in each of the countries where it is regulated.

Some of Tickmill’s key features are listed below:

Tickmill Strengths and Weaknesses

Tickmill’s a heavily regulated Broker with a good reputation. The company is globally recognized and offers good trading conditions for Professional or regular-size traders. Tickmill has one of the best learning and research materials and is great for EA trading.

For the Cons, proposals vary according to the entity and there is no 24/7 support, spreads for Forex are a little higher than average.

| Advantages | Disadvantages |

|---|---|

| Regulated broker | Conditions vary according to regulation and entity |

| Globally recognized and multiple awarded broker | No 24/7 customer support |

| Standard and Pro trading conditions | |

| Competitive trading costs and commissions | |

| Excellent support, learning, and research tools |

Licenses and Regulations

Tickmill is licensed by 5 global regulators including the top-tier UK’s FCA, the CySEC, FSCA, Labuan FSA & South Africa’s FSA.

Here’s a full list of the licenses, which are held by Tickmill’s subsidiaries:

| Legal entity | Registered in | Regulator | License Number | Compensation Scheme Amount | Accepting clients from |

|---|---|---|---|---|---|

| Tickmill UK Ltd | Großbritannien | Financial Conduct Authority (FCA) | 717270 | £85,000 | Globally many countries |

| Tickmill Europe Ltd | Cyprus | Cyprus Securities and Exchange Commission (CySEC) | 278/15 | €20,000 | Globally many countries |

| Tickmill South Africa (Pty) Ltd | South Africa | Financial Sector Conduct Authority (FSCA) | 49464 | No protection | South Africa |

| Tickmill Ltd | Seychelles | Financial Services Authority of Seychelles (FSA) | SD008 | No protection | Globally many countries |

| Tickmill Asia Ltd | Malaysia | Financial Services Authority of Labuan (Labuan FSA) | MB/18/0028 | No protection | Globally many countries |

Is Tickmill Safe

Yes, Tickmill is safe to trade. Tickmill’s regulation by the FCA and CySEC means that traders registered under the two entities are entitled to deposit compensation schemes of up to £85,000 and €20,000 respectively.

We did not encounter any major issues when trading and making withdrawals with Tickmill.

For this review, we opened an account under Tickmill UK Ltd which is regulated by Financial Conduct Authority (FCA) for our tests where we deposited money, placed trades, and withdrew our funds.

We recommend that you register your account with the UK entity, if it’s available to you, as we consider FCA regulation as the best since it provides compensation of up to £85,000 if the broker goes bankrupt.

Fees and Commissions

Tickmill charges low fees for stock index trades, while forex and commodities fees are average to high.

Spread Charged in our Trades

In our tests, we chose the popular instrument in each market. We placed 3 trades for each instrument to get a complete picture of the average spread. We tested the Classic Account which only charges a spread without commissions. Overall, the spread is stable as shown in the table below.

| Markets | Instruments | 1st trade | 2nd trade | 3rd trade | Avg. Spread |

|---|---|---|---|---|---|

| Forex | EUR/USD | 1.6 | 1.6 | 1.7 | 1.63 |

| Indizes | FTSE 100 | 1 | 1 | 1 | 1.00 |

| Rohstoffe | Gold | 2.4 | 2.6 | 6.4 | 3.80 |

We traded through MT4 on our iPhone which we video recorded the trades. You see this them here.

Comparing the spreads charged in our trades to industry benchmarks, we found the spread on stock indices to be quite low, but the spreads on Forex and commodities were in-line with industry averages or higher.

| Markets | Instruments | Avg. Spread Charged | Industry Avg. Spread |

|---|---|---|---|

| Forex | EUR/USD | 1.63 | 1.16 |

| Indizes | FTSE 100 | 1.00 | 1.65 |

| Rohstoffe | Gold | 3.80 | 3.53 |

Other fees

Tickmill does not charge non-trading fees such as account inactivity fees as well as deposit & withdrawal fees.

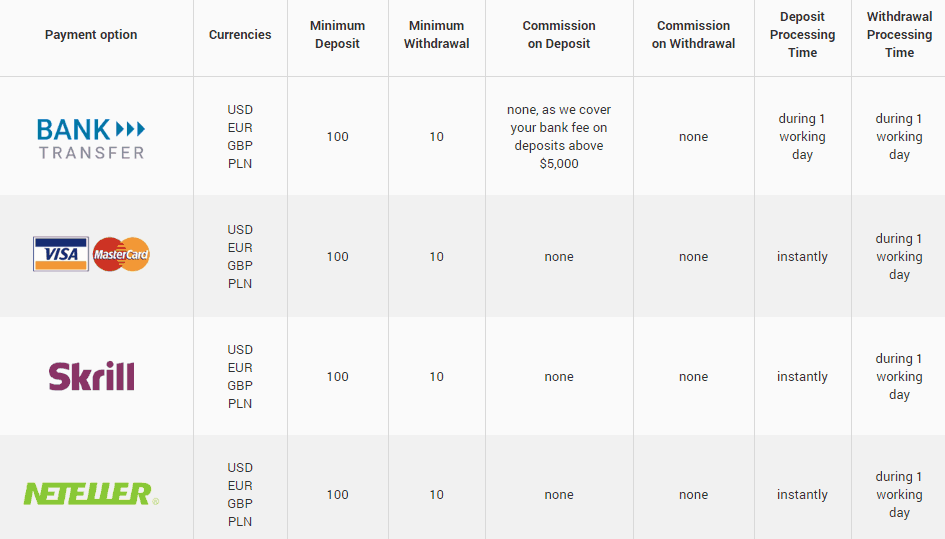

Deposits and Withdrawals

For the Deposit or Withdrawal options, Tickmill uses convenient methods to perform payments with ease and diversity. However, some options are only available to residents of certain countries.

- Tickmill Funding Methods we ranked good with an overall rating of 9 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for Tickmill funding methods found:

| Tickmill Advantage | Tickmill Disadvantage |

|---|---|

| $100 is a first deposit amount | Conditions may vary according to entity rules |

| Fast digital deposits including Skrill, Neteller, and Credit Cards | |

| No internal fees for deposits and withdrawals | |

| Multiple account base currencies | |

| Withdrawal requests confirmed within 1 working day |

Deposit Options

In terms of funding methods, Tickmill offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller

- UnionPay, and more

Tickmill Minimum Deposit

The Tickmill minimum deposit is $100, which is a great opportunity for traders of even very small sizes. However, to get a VIP account, you have to reach a minimum balance of $50,000.

Tickmill minimum deposit vs other brokers

| Tickmill | Most Other Brokers | |

|---|---|---|

| Minimum Deposit | $100 | $500 |

Tickmill Withdrawals

Tickmill has a zero-fee policy, where no charges or fees are applicable to monetary transactions. All deposits from $5,000 also include a zero-fee policy and all fees up to $100 will be covered. The broker typically processes withdrawal requests within 1 working day.

How Withdraw Money from Tickmill Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Tickmill Account types

Tickmill offers 3 account types, that is, the Pro, Classic, and VIP accounts. See the differences below:

| Pro | Classic | VIP | |

|---|---|---|---|

| Minimum Deposit | $100 | $100 | $50,000 |

| Minimum Balance | $0 | $0 | $50,000 |

| Spreads from | 0.0 pips | 1.6 pips | 0.0 pips |

| Commissions | 2 per side per 100,000 traded | Zero Commissions | 1 per side per 100,000 traded |

Tickmill also offers swap-free forex accounts. The main difference with Islamic accounts is that instead of daily swap rates, there is an administration fee charged if you hold for more than 3 nights.

For our tests, we chose to open a Classic Account.

Tickmill Trading Platform

Tickmill offers highly secured and powerful trading platforms MetaTrader 4 Und MetaTrader 5 available via desktop, web, and mobile versions.

| Platforms | Tickmill Platforms |

|---|---|

| MT4 | Yes |

| MT5 | Yes |

| cTrader | No |

| Own Platform | No |

| Mobile Apps | Yes |

Web Trading Platform

The web platform is very useful for any size of trade since does not require any installations, but is reachable right from your browser. Yet, this platform is rather limited with tools and drawing instruments so for comprehensive analysis you would definitely need a desktop version.

Desktop Platform

Tickmill desktop platforms have been enhanced with a variety of useful tools including Autochartist, Myfxbook AutoTrade, One Click Trading, Tickmill VPS, Forex Calendar, Forex Calculators, etc.

Tickmill strives to reach success trading among their client, hence they do not impose restrictions on profitability and allow all trading strategies including hedging, scalping, and arbitrage. Nevertheless, be sure to verify conditions with particular entity regulatory restrictions as those may apply.

In our test, we placed all our trade through the MT4 app on our iPhone.

Tickmill Education

Another good point to note in Tickmill proposal and offering is the established Learning Center along with a professional Trading Blog where traders can find recent updates, various educational materials, and educational programs designed to develop skills and knowledge.

Online webinars, live market analysis, technical analysis, regularly held seminars, and traders community of minded traders are all at a very good level and available for all.

Education ranked with an overall rating of 9 out of 10 based on our research. The broker provides very good quality educational materials, and excellent research also cooperates with market-leading providers of data.

Customer Service

Tickmill’s customer support team was helpful and provided relevant answers to our questions.

You can contact Tickmill via Email, and Phone calls. However, we could not reach anyone by phone as our calls went unanswered.

We were disappointed to find out that the broker does not have a Live Chat function, which is a crucial support channel offered by most brokers.

Conclusion

Our overall experience was smooth. Tickmill allows traders to trade with almost any trading strategy including scalping, which is great for day trading Und EA trading. Tickmill also allows traders to change their leverage levels and…

As compared to other brokers. Tickmill offers a limited number of markets and instruments, and we hope that they will add shares CFDs, cryptocurrencies, and ETFs in the future.

We recommend Tickmill for traders who run EAs, scalping and prefer the MT4 platform, as well as those interested in trading with FCA-regulated brokers.

We recommend Tickmill for traders who are

- Experienced traders

- Beginners

- Run Scalping

- Hedging

- EAs trading

- Trading through MT4

Tickmill might not be a fit if you are

- Real Stock / Futures Trading

- Commission based trading

- Prefer other platforms rather than MT4

Top Tickmill FAQs

We do offer Cash CFDs that allow you to trade with a continuous price that isn’t subject to an expiration date. The Cash CFD price is derived from the underlying futures contracts.

You can make a deposit inside your Client Area using a funding option that suits you best. There are no fees on deposits.

You can open an account in the Client Area, efficiently and securely. Click here to open an account with us.

Tickmill provides you with low spreads starting from 0.0 pips and ultra-fast execution speed of 0.15 second on average. Skrill, Neteller, FasaPay, UnionPay and credit card deposits are processed instantly while withdrawals are processed within one working day. We are proud that we have no restrictions on trading and no requotes. We also allow scalping, hedging, arbitrage, EAs and algorithms.

Tickmill is a trading name of Tickmill Ltd, which is regulated by the Seychelles Financial Services Authority (FSA).

Tickmill is also a trading name of Tickmill UK Ltd, which is authorised and regulated by the Financial Conduct Authority (FCA) of the United Kingdom and the Dubai Financial Services Authority as a Representative Office, of Tickmill Europe Ltd which is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), of Tickmill Asia Ltd, which is authorised and regulated by the Labuan Financial Services Authority and of Tickmill South Africa (Pty) Ltd, which is authorised and regulated by the Financial Sector Conduct Authority (FSCA).

Tickmill Ltd is regulated as a Securities Dealer by the Seychelles Financial Services Authority (FSA). As such, our internal systems are in compliance with the FSA regulations, which means that your funds are held in segregated accounts to protect your assets.